How Property Taxes Can Influence Homeownership

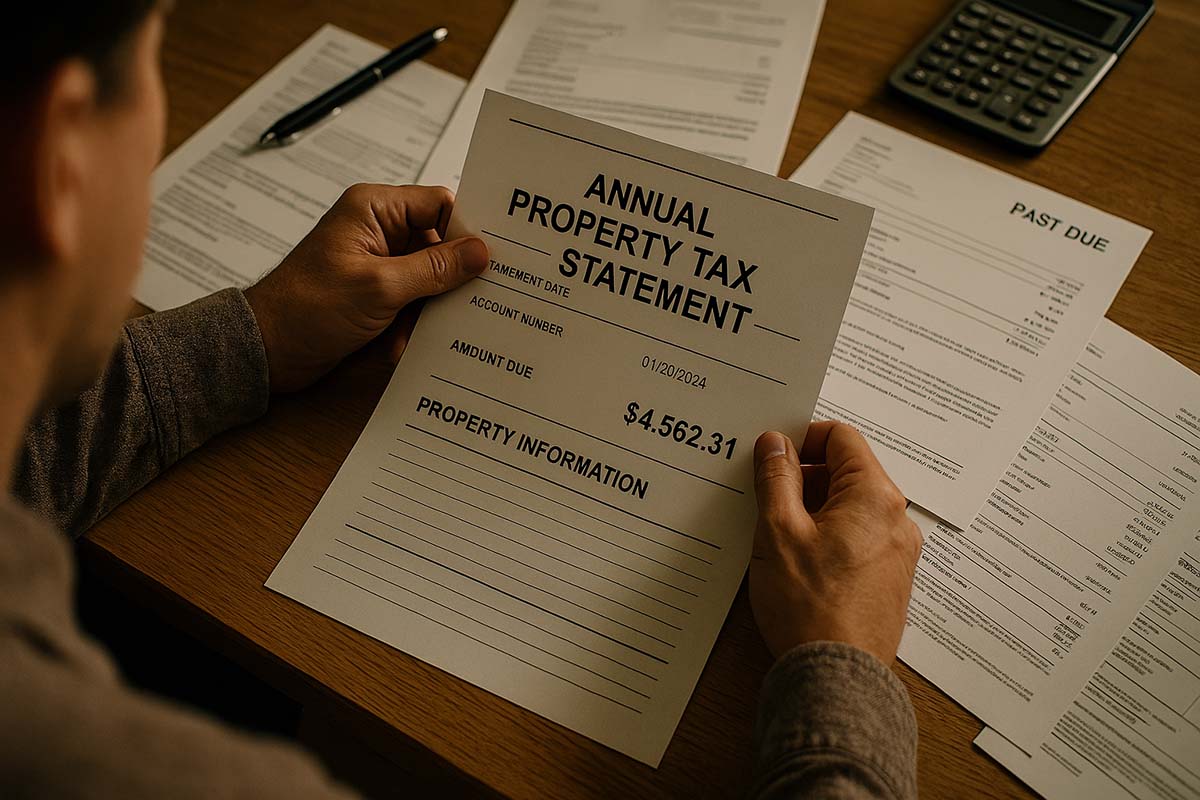

Owning a home is more than just having a roof over your head—it’s one of the biggest financial commitments most people will make. But while many focus on mortgage rates, down payments, and home inspections, one important cost often flies under the radar: property taxes. These recurring fees can quietly shape a homeowner’s financial life in major ways.

It’s not just about paying the bill each year. Property taxes can influence everything from your monthly budget to where you choose to live. They affect how homes are valued and sold, and they even determine the quality of services in your neighborhood. Whether you’re buying your first home or thinking of relocating, understanding how property taxes work could save you a lot of trouble later on.

Quick Look at What You’ll Learn:

- How property taxes fit into the bigger picture of homeownership

- What factors affect how much you’ll pay

- Why these taxes matter to buyers and sellers alike

- Practical steps to reduce or manage your property tax burden

Why Property Taxes Matter More Than You Think

It’s easy to get excited about the idea of owning a house, especially if you’ve been renting for years. But the reality of monthly bills can hit hard, and property taxes are one of the biggest recurring costs that homeowners often forget to plan for.

In cities where tax rates are high, the annual amount can reach thousands of dollars. For example, a home worth $500,000 with a 2% tax rate means $10,000 in property taxes every year. That’s over $800 per month added on top of your mortgage and insurance.

Some homeowners are even forced to move because they can’t keep up with these costs. Over time, property taxes can feel like a second mortgage. And because they’re based on your home’s value, the bill tends to go up—not down.

That’s why understanding property taxes early can help you choose a home you can truly afford—not just today, but long-term.

What Are Property Taxes, Really?

Property taxes are fees paid to the local government, usually based on the value of your home and land. The more valuable your property, the higher your tax bill. Local assessors typically determine this value, and they may reassess it every few years—or even yearly in some areas.

These taxes help fund public services like schools, parks, road maintenance, and emergency services. In a way, they’re what keep your neighborhood running. Without them, trash wouldn’t get picked up, and public school budgets might shrink. You’re not just paying for your property—you’re helping pay for the entire community.

But while that sounds good in theory, the burden on individual homeowners can vary widely. A homeowner in one city might pay twice as much as someone in a nearby town, simply due to differences in local tax policies. This can lead to big decisions—like choosing to buy in a different school district or downsizing to avoid future tax hikes.

Common Effects of Property Taxes on Homeownership

Higher Overall Costs: Monthly mortgage payments might look affordable on paper, but property taxes add a layer of cost that can make or break your budget. Homeowners with fixed incomes, like retirees, are especially vulnerable. And if your mortgage includes an escrow account, rising taxes could mean higher monthly payments even if your loan terms stay the same.

Reduced Market Value: Areas with high property taxes can struggle to attract buyers. Even if a home is beautiful and well-maintained, a heavy tax burden can turn people away. Buyers compare total monthly costs, not just sticker prices. A $400,000 home with high taxes might be less appealing than a $450,000 one in a low-tax area.

Financial Pressure: When times are tough—job loss, medical bills, inflation—property taxes don’t go away. Falling behind can lead to penalties, liens, or even foreclosure. For many homeowners, this becomes an unexpected source of stress that keeps growing year after year.

Increased Upkeep Costs: Some homeowners try to boost their property value through renovations, hoping to increase resale value. Ironically, this can trigger higher property assessments, which raises your taxes. In some cases, fixing up your house can backfire financially if you’re not careful.

How Buyers Make Decisions Based on Property Taxes

Taxes may not be flashy, but they play a huge role in how people choose where to live. A neighborhood with higher taxes might offer great schools and parks, but it comes at a cost. Buyers often face the trade-off between affordable taxes and access to quality services.

For families with young children, lower taxes might mean compromising on school quality. For others, especially investors or retirees, lower monthly expenses may matter more than amenities. These choices shape the real estate market by influencing where demand rises and falls.

There’s also the issue of long-term affordability. Some buyers avoid neighborhoods with a history of rising assessments or frequent tax hikes. They may settle on smaller homes or look for less developed areas just to stay within budget. This impacts how communities grow and evolve.

The Role of Property Taxes in Local Development

Though they’re often seen as a financial burden, property taxes serve a meaningful purpose. Without them, local services would grind to a halt. Public school funding, street repairs, libraries, and even snow removal depend heavily on these funds.

Services That Benefit From Property Taxes

- Education through public schools

- Fire and police services

- Road and sidewalk repairs

- Community programs like senior centers and libraries

In wealthier areas with high property values, these services are usually better funded. That’s one reason why some school districts have newer buildings and better technology than others—more valuable homes bring in more tax dollars. Unfortunately, this can widen the gap between rich and poor communities.

So while property taxes can be tough on homeowners, they’re also vital for maintaining quality of life. The challenge is balancing fair rates with community needs.

Simple Ways to Handle Property Taxes Better

You don’t have to be caught off guard. With a little planning, you can handle property taxes more confidently and avoid unexpected hits to your wallet.

Include property tax in your monthly budget: Don’t treat it as a surprise. Divide your yearly bill by 12 and set that amount aside every month.

Understand your local exemptions: Some cities offer tax breaks for veterans, seniors, or low-income households. You might qualify without realizing it.

Appeal your property assessment: If your tax bill seems unusually high, check the assessed value. If it’s above market value, you can request a review or file an appeal.

Keep track of improvements: Before making upgrades to your home, find out how they could affect your tax rate. In some areas, even minor additions like a new deck can raise your assessment.

Property taxes can feel like a small detail at first—but they have the power to affect everything from where you live to how secure you feel in your home. They shape budgets, influence communities, and determine the quality of local services.

By understanding how they work and planning ahead, homeowners can avoid surprises and make smarter, more sustainable choices. Whether you’re buying your first home or managing one you’ve lived in for years, keeping an eye on property taxes is one of the smartest things you can do for your financial future.